How To Register The Payable Income Tax Quickbooks

Let me clear upwards the confusion for you, @mikelu9661.

Based on your scenario, it looks like you're a cocky-employed individual. You can write checks to record the paid quarterly estimated revenue enhancement payments using QuickBooks Online (QBO). Even so, this may non exist the right product for you. Residue bodacious that I have another QuickBooks product that fits your self-employed needs. It's necessary to record the taxes to make sure your taxation info is accurate.

Get-go, I'd propose checking out the features of QuickBooks Self-Employed (QBSE). This software volition aid you track your business-related transactions. Also, you canmake quarterly estimated tax payments from there. Then, file your Schedule C along with your almanac taxation render (1040). For more information, visit this commodity: QBSE Overview.

Once reviewed, I recommend signing up for a QBSE account.After that, you tin record your estimated tax payments in the program in three ways. I'll guide yous how.

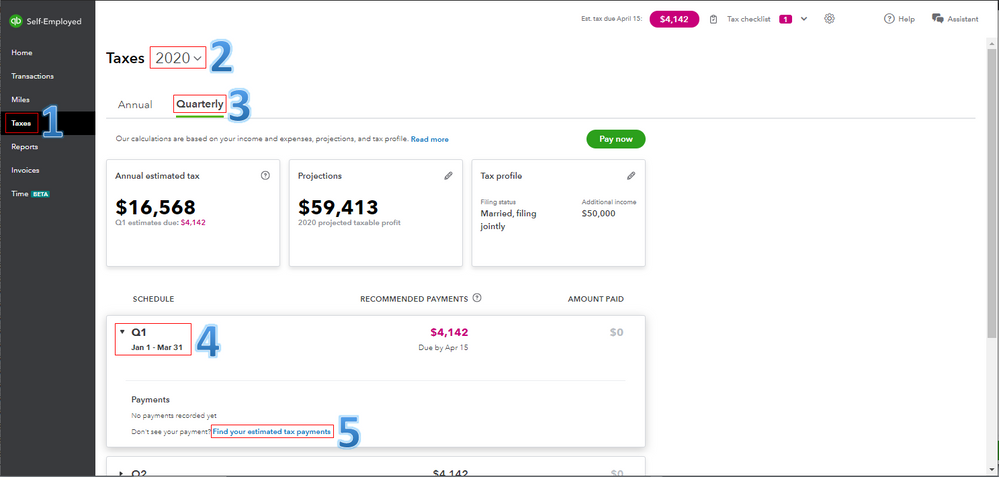

For the first option:

- Get toTaxes from the left card.

- Set up the twelvemonth.

- Select theQuarterly tab.

- Choose the quarter you want to marker the revenue enhancement payment for.

- ClickFind your estimated tax payments beside Don't run across your payment?.

- Check off the revenue enhancement payment.

- HittingMark every bit tax payment.

The screenshot below shows you the first five steps.

Second, let's go to the Transactions tab to cheque your business spending transaction. And so, manually assign its category fromTaxes & Licenses toEstimated Taxes.

3rd, if y'all printed a tax payment coupon, nosotros automatically friction match the spending transaction when information technology appears in our organization. Please accept note that nosotros don't count estimated taxes every bit "paid" when you print it. For more details, check out this article: Schedule C: Estimated Taxes.

If y'all want to pay the taxes electronically,you'll have the pick to pay straight to eftps.gov or within QBSE. For detailed steps,see the Make payments online section through this article: Estimated Taxes.

Your estimated taxes will appear on theTax Summary and Tax Details reports. These won't show on theProfit & Loss report. To learn more nigh this, come across theEstimated taxes section through this commodity: QBSE Schedule C Categories Breakdown. This link provides you more than information on where the other accounts will appear on diverse reports in the software.

Moving forward, you lot may cancel the QBO account in one case you've verified that QBSE suits your self-employed needs. This ensures yous won't accept duplicate subscription charges.

I'll exist right here to help if you need further assistance. Take a great residue of your weekend, @mikelu9661.

Source: https://quickbooks.intuit.com/learn-support/en-us/taxes/how-to-record-paid-estimated-tax-payment/00/519393

Posted by: navarrohimed1979.blogspot.com

0 Response to "How To Register The Payable Income Tax Quickbooks"

Post a Comment